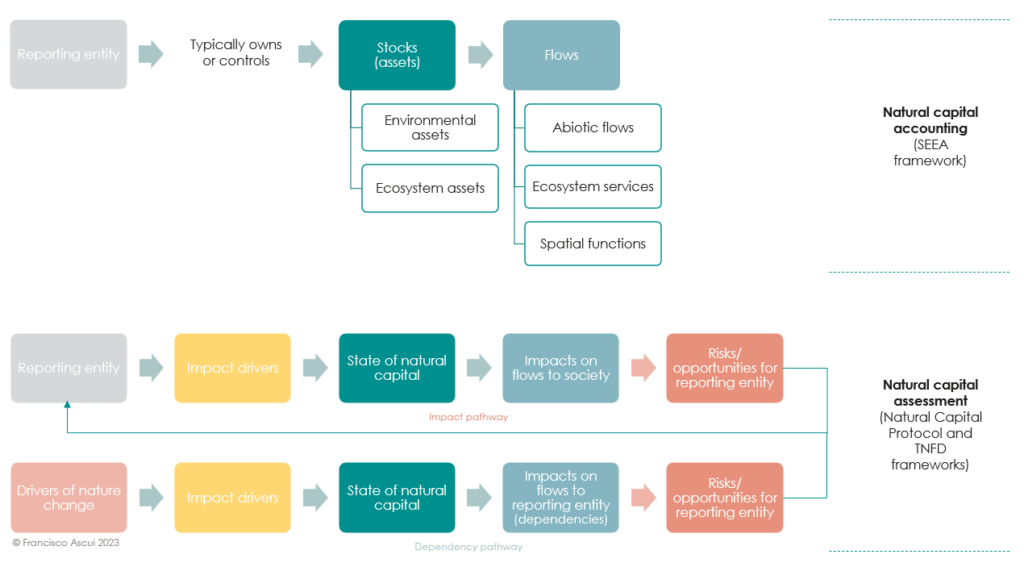

The main focus of natural capital accounting is on natural assets, and the flows of benefits derived from those assets. When applied at a country level, the scope is defined by territorial boundaries, whereas when applied at the level of an individual entity, the scope would normally be defined by the entity’s ownership or control.

Natural capital assessment considers the reporting entity’s impacts and dependencies on natural capital through the concept of impact and dependency pathways, and may involve any natural capital causally related to the entity through these pathways, regardless of territory, ownership or control. Both impact and dependency pathways involve changes to the state of natural capital (equivalent to accounting for stocks of natural assets) and changes to flows (equivalent to accounting for flows of benefits from natural assets), but they are differentiated according to the principal cause and effect of these changes.

Impacts involve changes caused by the reporting entity, which may ultimately result in consequences for the reporting entity (such as increased regulation, fines or loss of access to certain markets).

In the case of dependencies, changes are typically caused by wider change drivers (such as climate change) which may ultimately result in consequences for the reporting entity due to changes in the availability of flows that the entity depends or relies on.

Importantly, it is not always necessary to fully account for changes in the state of natural capital, or the availability of flows, in order to characterise an entity’s impacts or dependencies. For example, information on an entity’s greenhouse gas emissions (an impact driver) may be sufficient, without also providing a full account of the state of greenhouse gases in the atmosphere. Likewise, information on the availability of essential flows to a reporting entity may be sufficient, without also providing a full account of the state of the natural capital asset(s) that provide those flows (particularly when the natural capital assets in question are now owned or controlled by the reporting entity, it may be unreasonable to expect them to provide such information).

For more help navigating your overall approach to natural capital accounting or natural capital assessment, we recommend accessing CSIRO’s Natural Capital Handbook (Smith et. al., 2023).

This diagram illustrates some important relationships between natural capital accounting and natural capital assessment.